2018 Predictions

Monday, January 1, 2018 at 12:21PM

Monday, January 1, 2018 at 12:21PM Here are my predictions for 2018.

1. The stock market will increase 10%.

2. The stock Market will crash 30%.

3. The stock market will decrease 10%.

4. The stock market will rise 30%.

Confused? You are not alone. There are several reason why I am making contradictory predictions. First, this is the way the prophecy game works. You make contradictory predictions and only point out the ones that ended up correct. There is even a Twilight Zone episode about this.

But I am following my usual practice of having my even number predictions not being serious. So I do not expect a large increase or decrease in the markets. But either of these options is possible. With the expected repatriation of overseas money legally, but immorally, placed/left overseas, there will be a lot of investments and stock buybacks. The reduction in the corporate tax rates will also increase corporate profits. This seems an unlikely outcome as the rate of corporate profits is the highest in modern history. But nevertheless it is what will probably happen. This could mean another 30% increase for this year like last year.

Since the stock market is actually higher in relative terms than it was in 1929 before the great depression, one would think that the market will crash. One would be wrong. I still can't believe I am saying this. There will not be a crash for several years. Since the longest period without a recession is 118 months and we are in month 114, this prediction seems unlikely. But looking at the madness that is Japan, the US has a long way to go before the fiscal madness gets out of control. (It is already out of control, but the bubble still has a long way to go.) I think that the stock market will go up slightly next year, prediction 1.

5. The 1.5 trillion estimated deficit increase that will be the consequence of the Trump tax cut will not even cause a hiccup in the markets. No one will care.

6. Krugman, since there is a Republican in office will continue to prediction dire consequences, and he will continue to be wrong, as he was when he predicted that the internet would not have a significant impact on business and his prediction that the Trump stock market would be bad. The prediction biz is tough.

7. The real estate market in Southern California is nuts. If my family had kept any of our family homes from the 60's and 70's, I could sell it and retire to Costa Rica and live the live of leisure. One would think this would mean I am predicting a crash. I am not. Everyone seems to be buying houses and then renting them out. Many rentals on the market are in this category. As long as interest rates are low, this will continue. I do wonder how many of these new landlords are committing loan fraud by claiming they will live in the unit.

8. Bitcoin will rise to $50,000.

9. There will be no evidence that Trump colluded with anyone, but there will be a lot of noise about it. There will be charges, but the charges will have nothing to do with Russia. I do not think one can be in business and not violate some law somewhere. For example, if a business charges less than the competition, they are trying to monopolize and drive the competition out of business; if you are charging the same amount, then you are colluding; if you charge more, then you are using your market position to cheat the consumer. You can't win. To channel Jan Brady from the Brady Bunch, instead of "Marcia, Marcia, Marcia." It will be "Russia, Russia, Russia."

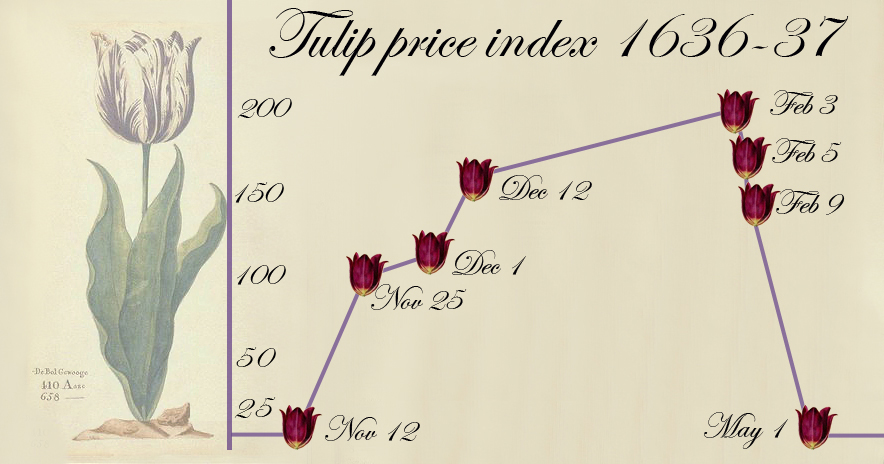

10. No one will care that no evidence will be found and Trump will still be declared guilty in the court of public opinion. I advise that everyone who can should get out of debt. I am trying to do that. But it is tempting to just go out and buy the tulips. I will be smart enough to know when to sell. Right?

Economics

Economics

Reader Comments